Can You Afford To Incorporate AND Maintain An HK Company?

There’s no denying the feeling you get when you are starting your very own business. You’ve got your idea, and you want to get it setup right away. Great! But, before going any further, we’d like to give you a piece of advice; don’t get caught up in the excitement. Setting up a company is a long-term responsibility. Can you afford to incorporate and maintain an HK company? Once set up that is not the end of it! Don’t get us wrong; we don’t want to dampen your plans, but having seen many an entrepreneur make this mistake we simply had to write about it. We already touched on this topic briefly in our 6 Tips You Should Keep In Mind When Incorporating A Company, tip no.2: Remember, you are required to manage the company after it is incorporated! But now we’re going to elaborate on this point so you can better understand just how much time and money it takes to maintain a company.

To begin with, there are three main areas of maintenance that you should keep in mind; these include, the legal requirements, accounting, and audit, as well as profits and employer’s tax filing. Overall there are few basic requirements, but they all must be met, and they must be met correctly. There are no shortcuts!

Legal Requirements

First and foremost a Hong Kong company must maintain proper records; any changes made to the company such as change of name, address, changes to directors particulars, transfer/allotment of share or appointment of director, must be reported to the Companies Registry. Even if there are no changes, there are at least 2 compulsory requirements which are the business registration renewal (BRC) and filing of annual return (AR) and both must be done on a yearly basis.

Accounting & Audit

Accounting and audit are related to the Profits Tax Return (see below). You must have accounting to do the audit, while apart from a few exceptions you need to have audited accounts to file the Profits Tax Return. Having said that it is important to note that audit is compulsory.

Profits Tax Return & Employer’s Return

Regardless of whether you have profit or employees, you must file a Profits Tax Return and Employer’s Return respectively. They are necessary declarations that must be made to the Inland Revenue Department.

In Summary…

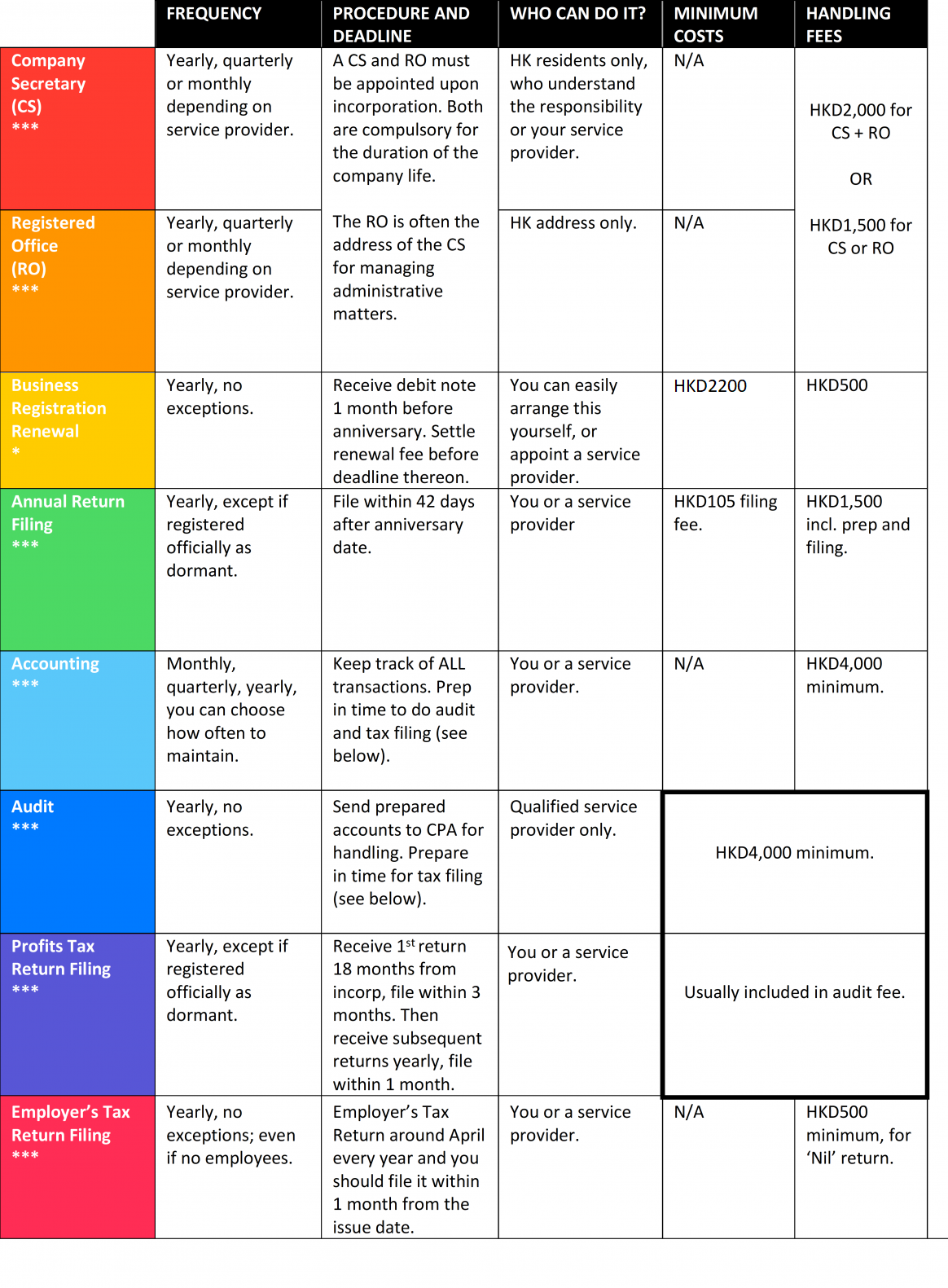

To make it easy, we’ve summarized all the basic post-incorporation requirements and minimum costs below. We’ve included a professional fees section under which we have put iNCUBEE’s fees, to reflect the potential cost of appointing a service provider. But be aware that the cost of appointing a service provider can vary greatly. As such, you can choose to replace that column with the costs of other service provider fees you may consider or no fees at all if you decide to do things yourself.

Keep in mind, however, as we have mentioned on many occasions, while you may be able to handle some of the requirements yourself, it is highly advisable to appoint a service provider to handle the majority of them to avoid mistakes, delays, and penalties. To help you gauge which ones you can easily handle yourself, we’ve marked the difficulty of each requirement, whereas * = easy and *** = difficult.

[NOTE: Business Registration Renewal fees can vary from year to year for latest fees please refer here]