Deregistration for a Company in Hong Kong

Deregistration for a Company in Hong Kong

Are you looking to close down your Hong Kong company? A company could consider liquidation or deregistration. However, out of the two, the cheapest and simplest option would be the latter, i.e. legal deregistration. Legal deregistration is the process of dissolving a defunct and solvent private company or a company limited by guarantee.

To ensure smooth handling, you’ll need to bring your company up to date with basic requirements and tax filings before submitting your application. However, note as deregistration is a long process (minimum 6 months!), so you may need to continue handling some basic requirements while you wait.

Read on for more specifics of what you can expect and will need to take into consideration before, during and after deregistration.

Before and During Deregistration: What You Need to Handle

Entrepreneurs often approach us looking to dissolve their Hong Kong company, but it has been a while, perhaps even years, and they have not commenced any business. Usually, we find that they have some misconceptions that have arisen out of this situation. The owner typically thinks:

- “As my company was ‘dormant’ I didn’t need to comply with basic requirements”;

- “I officially registered as dormant, so I didn’t need to and didn’t comply with basic requirements”; or

- “Now I need to deregister I can simply proceed to dissolve my company and will not need to meet basic requirements.”

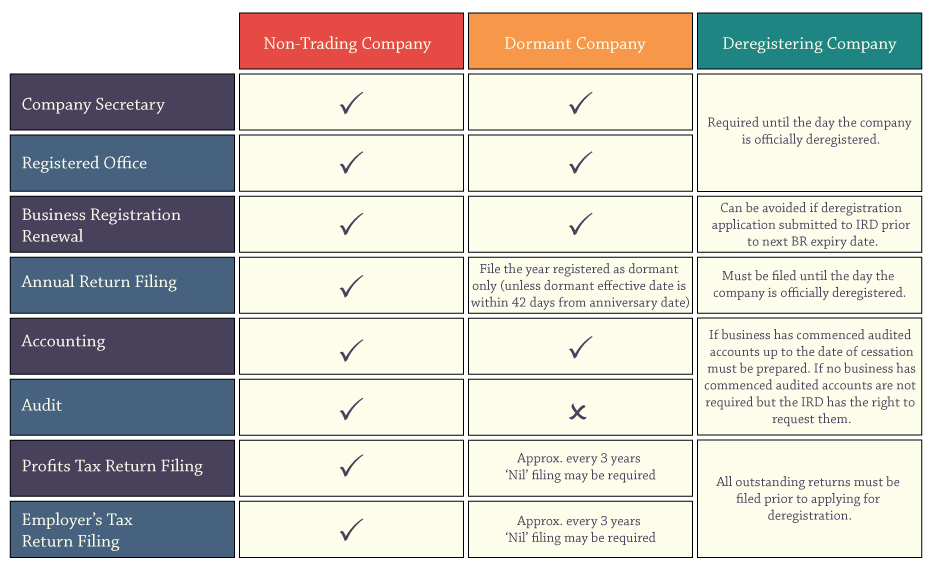

All those statements are untrue; in fact, they couldn’t be further from the truth. Just check out our posts Non-Trading Company, Dormant & Deregistration, and Deregistration Quiz: Are You Ready? How To? You’ll see there are quite a few requirements that need to be attended to even if your company is non-trading, dormant, or in the process of deregistration.

For a quick overview of what needs to be handled for such cases, you can check out our summary below. But note that this is only a basic comparison; you are highly recommended to read our other articles to better understand the specifics.

*Note: By a “Non-Trading Company”, we mean a company that is not operating and has had no business. A “Dormant Company”, on the other hand, is a company officially registered as dormant at the Companies Registry. For details about how often you need to handle each requirement and the estimated cost for assistance with the same, read our post Can You Afford To Incorporate AND Maintain An HK Company?

Prepare Your Company For Deregistration

Now that’s cleared up, what about deregistration itself? Where do you start? First, you need to make sure your company is up to date with the above-mentioned basic requirements. You should make sure to renew your business registration with the Inland Revenue Department (IRD) and file your annual returns to the Companies Registry up to the latest year they are due. Your Company Secretary can help you with these matters.

Once you’ve cleared out the essential maintenance, make sure to file all outstanding Profits Tax Returns (PTRs) to the IRD, if any. If your company has commenced business, make sure to file your PTRs with the related year’s audit. Note it can take 3 months or more for the IRD to review an audit, so your prompt action is recommended. After IRD has finished reviewing, they will issue a tax assessment. If any tax is payable, you should settle it within the specified due date.

Deregistration Step By Step

Handled all of the above? Now you’re ready to initiate the process to apply for deregistration by following these next steps!

- Prepare audited management accounts for your company up to the date of cessation of business. If you haven’t commenced any business operations, you can skip this step. Need help with the preparation of audited management accounts and deregistration? We can assist with both as follows,

-

- Audited management accounts: Fill in this short questionnaire for a quote.

- Legal deregistration: Our fees are HKD8,500.

- Submit an application for no objection to a company being deregistered to the IRD together with the final audit report (a.k.a. cessation report), if any. Note if you report a profit, the IRD may subsequently issue a PTR, which must be dealt with before no objection will be granted. Notice of no objection is usually issued within 1 month of submission of an application.

- Once you have obtained from the Commissioner of Inland Revenue the “Notice of No Objection to a Company being Deregistered”, make sure your company meets all of the following criteria before proceeding to the next step:

-

- All of the company’s shareholders/members have agreed to the deregistration;

- The company hasn’t commenced operation or business or hasn’t been operating or carrying on any business for the 3 months immediately preceding application for deregistration;

- The company has no outstanding liabilities;

- The company is not involved in any legal proceedings;

- The company has no immovable property situate in Hong Kong among its assets;

- In the case of a holding company, the company should ensure none of its subsidiary’s hold any immovable property situate in Hong Kong among its assets.

- Submit an application for deregistration to the Companies Registry within 3 months of issue of the no objection letter from IRD (otherwise, it expires, and you have to apply all over again!). The Companies Registry will send you a letter to confirm receipt of your application.

- Ensure proper disposal/closure of all the Company’s property (including bank accounts), if any, before deregistration is finalized. Otherwise, all property that hasn’t been properly disposed of will considered as bona vacantia and be vested in the Government of the HKSAR. Here are a few examples of assets and liabilities you’ll want to clear, where applicable:

-

- Get rid of any stock, machines, vehicles, land and property;

- Clear out any balance still kept within company bank accounts before proceeding to close the same.

- Settle all outstanding debts, loans, etc. As an alternative, directors, shareholders/members, or related companies can settle the debts on behalf of the company OR if creditors agree, they may be considered as waived.

- Now, simply wait. The Companies Registry will publish a Gazette notice of the application for deregistration for the public to see and raise an objection if any. If no objections are raised, around five months from the date you submit your application for deregistration to the Registrar of Companies, your company will be officially deregistered.

After deregistration

Once deregistration has been finalized, as per the Companies Ordinance, the latest director(s) of the company should ensure that the company’s books and papers are kept for at least 6 years after the date of the dissolution. So do make sure your directors are aware of the same.

If, for any reason, you should decide to reinstate/restore the company, this is also possible within a period of 20 years from the date of official deregistration. Reinstatement can be effected by a director, shareholder/member or creditor, by submitting an application for the restoration of a company to the Companies Registry.

Want to proceed with deregistration or have more questions?

Read our related article: