How to Register a Dormant Company or Deregister in Hong Kong – Guide

How to Register a Dormant Company or Deregister in Hong Kong

You may need to delay the launch of your operations or put your business on hold. In some cases, deregistration might be necessary. Understanding your options for dormant company status or deregistration can help reduce costs if done right. Read on to explore your options.

What is a Dormant Company in Hong Kong?

In Hong Kong, legally, a dormant company is a limited company with “no significant accounting transactions” within a financial year. Unlike a “non-trading company” (a term without legal definition), a dormant company has no financial entries in its accounting records.

No Significant Accounting Transactions

“No significant accounting transactions” means there are no entries in the company’s records. However, initial share capital and minimal fees needed to keep the company registered do not count as significant transactions.

Non-Trading Company: What It Means

If your company has no activity, business, no bank account and doesn’t own any subsidiaries, it could be considered as a “non-trading company”. As mentioned however, “non-trading company” doesn’t have any legal meaning, and as such, maintaining one requires certain actions:

- Despite having no activity or business, you must prepare a profit and loss statement and a balance sheet to account for the minimal transactions related to capital and formation expenses.

- The company still has to do an annual audit.

- Annual Business Registration (BR) fees and Annual Return (AR) filing and it’s related fees are still applicable.

Dormant Company Requirements in Hong Kong

So, if your company has no activity, you may want to consider to officially register it as dormant. If you decide to take this step it is important to note:

- You will still need to pay the annual BR fee.

- An AR is required only for the first dormant year unless effective dormancy starts within 42 days of the incorporation anniversary.

- Bookkeeping is still necessary, although audits aren’t required (unless you decide to come out of dormancy).

Is Dormant Status Right for Your Business?

If you don’t intend to operate your business within a short-term period (less than 2–3 years), you can consider officially registering your company as dormant. You will incur some professional fees to begin with, but overall costs will be kept to a minimum in the long run.

When to Consider Deregistration

On the other hand, if you have no plans to operate the company long-term (beyond 2–3 years), deregistration may be a better option despite the higher initial costs. After deregistration, you’ll no longer face ongoing fees.

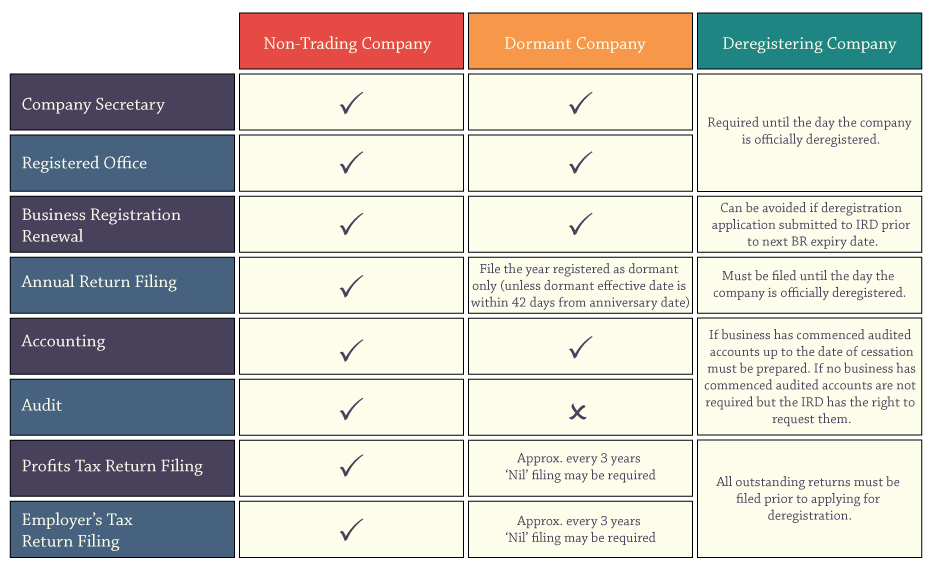

Summary: Comparison of Options

Considering your options? Check out our infographic below for a quick comparison of the ongoing requirements for a non-trading company, dormant company, or company undergoing deregistration.

Need further assistance in making your choice? Get in touch with our friendly customer service team.

The iNCUBEE Team will be pleased to answer you. Visit our website.