How To Pay Employees, Directors, and/or Shareholders

Hong Kong companies must keep proper records of all payments made to its employees, directors, and shareholders. These payments must eventually be declared to the Inland Revenue Department (IRD) in either the Profits Tax Return or Employer’s Return (for basics on how to deal with these check out our article You’ve Received Your Profits Tax Return and Employer’s Tax Return. Now What? Consequently, it is essential to understand what types of payments can be made to whom, and what are the implications of making them.

How To Pay Employees?

As defined in the Employment Ordinance, an employee is someone employed under an employment contract whether located in Hong Kong or not. Note an employment contract can be either a written or oral agreement. While aside from the obvious hired staff, directors that have entered into an employment contract with the company are also considered to be employees.

Employees are usually paid a regular salary as agreed between the employee and employer. Standard practice in Hong Kong is to pay employees a monthly salary.

Whereas if the total income received by an employee is in excess of the Basic Allowance of the relevant year of assessment (current rates here) then they will be required to pay tax on said excess. All employees are responsible for their tax unless the company offers to pay for it. For current individual tax rates in Hong Kong refer to the Government’s salaries tax rates table here. Any employee that is not in Hong Kong for more than 60 days of a tax year, whether a Hong Kong resident or not, can apply for individual tax exemption.

How To Pay Directors?

First, as already mentioned, if a director has an employment contract with the company they can receive a salary and the above implications apply. On the other hand, all directors whether they have “employee status” or not, are entitled to receive fees from their company. Such fees are more commonly known as director’s fees.

No matter where in the world a director is located, whether they hold resident status in Hong Kong or not, director’s fees will always be subject to salaries tax. I.e., even if a director is not a resident he will have to file and pay tax on director’s fees. Accordingly, director’s fees must always be reported at the same time as payments made to employees in the Employer’s Return to the IRD every April.

How To Pay Shareholders?

As a shareholder, you can be paid a dividend which is a distribution of profits made by the company.

Dividends must be reported in the Profits Tax Return to the IRD every year. Subsequently, any tax thereon is charged to the company, i.e., in Hong Kong dividends are not subject to individual salaries tax. For current profits tax rates in Hong Kong refer to the Government’s Tax Rates of Profit Tax table. However, if a shareholder lives elsewhere, they should check if they need to pay tax in the country where they are situated.

Note that dividend can only be paid after profits tax. So, it makes sense to consider whether it is better to pay profits tax first and then receive dividends after, or if it is more worth it to earn a salary and/or director’s fees to reduce a company’s taxable profit. Considering shareholders can also be employed and/or appointed as director.

Claiming Expenses

Companies can also support work-related expenses of its directors, employees, and shareholders. These expenses should be consistent with the company’s activities and the duties of the person claiming them. Typical examples include transportation costs for business trips, the cost for entertaining potential customers, etc. Just be careful that allowances and expenses are proportioned reasonably. For example, it is normal to claim expenses for entertaining potential customers, but if you keep claiming this type of expense and are not making any customers, then this doesn’t make any sense.

Summary

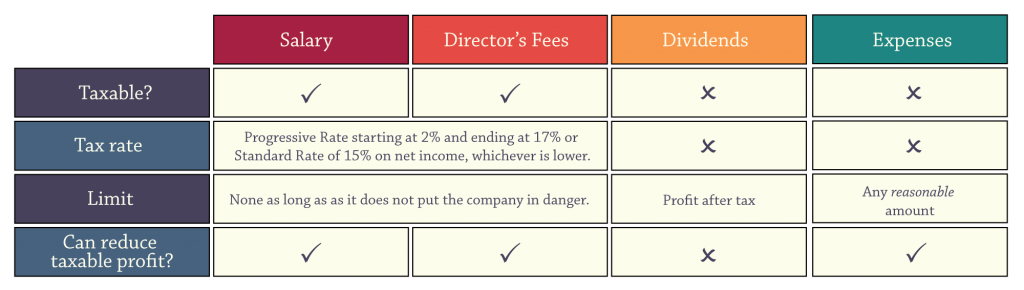

To help you decide what is the best way to pay yourself check out our summary of the above below.

Need help with payroll and/or handling an Employer’s Return or Profits Tax Return? Click below.

OR